School Funding

It's complicated.

Schools in Arizona are funded from three primary sources: state, local and federal. Of these, the state funding formula is by far the most difficult to understand, but gets the most attention although local funding provides almost as much, and in some districts more, money to the schools. This page provides summaries of each, plus links to just about as much detail as a masochist might be able to stand.

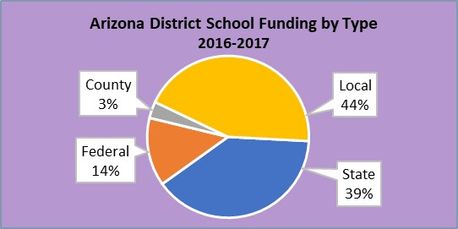

District School Funding

District school funding comes mostly from local property taxes and the state.

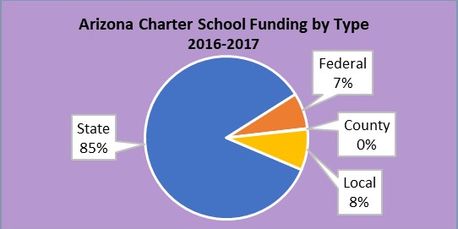

Charter School Funding

Most charter school funding comes from the state.

Summary

Local Funding

It may come as a surprise to some, but school districts in Arizona have taxing authority. Within well-defined limits, the districts can, on their own, raise your property taxes. It's not as simple as it sounds. Need ARS reference.

Districts can also propose additional bonds and overrides for approval by the voters in the district, above and beyond the base property taxes. If approved, bonds can provide significant funding for any purpose, but are often used for large capital improvements. Voters in wealthy districts can choose to fund very nice facilities. However, because of the state equalization formula, this can cause state funding to be reduced.

This presentation provides details on Gilbert's local tax calculation.

Charter schools, though they are public schools, cannot receive local property tax funding and cannot issue taxpayer-funded bonds. The "local" charter school funding in the graph above is generally from donations directly to the charter schools.

State Funding

Supporting education is one of the major responsibilities of the state described in the Arizona State Constitution. Arizona provides public district and charter schools a base amount of funds each year per student. Schools may get some additional funds for students with disabilities, English-language learners or based on grade level, for being very small and/or having more experienced teachers, as well as what's called District Additional Assistance for capital costs like transportation, technology and textbooks.

Here is an explanation dated October 2016 from the Arizona State Senate describing Arizona’s school finance system.

Here is a summary of the Arizona school finance system dated December 2009 from the Arizona Tax Research Association. Although several years old, the basic school financing structure in Arizona has not changed since major reforms in 1980. Additional reforms were Students FIRST in 1998 and the Prop 301 state sales tax increase in 2000 (extended for 20 years by the Legislature in 2018).

Because charter schools cannot receive local funding, the state partially offsets this lack with Additional State Aid funding, so the state funds charter schools at a higher level than it does district schools. However, the total state plus local funding for districts was $952 per student more than charter schools received from the state in 2017-2018.

Federal Funding

School districts, and to a lesser extent charter schools, can receive federal funding for a variety of purposes. These include free or reduced-cost lunches, desegregation funding, and other uses. Here is information on federal grants for education.

County Funding

Here is a presentation on Maricopa County's 2018 budget and property taxes. Only 1.6% ($39.6M) supports education, so this is a minor portion of schools' funding.

Tax Credits

Arizona law defines two types of education-related tax credits. The first is for Contributions to Certified School Tuition Organizations. These organizations then assist families with private school tuition. For tax year 2017, this credit (actually a combination of two credits) was $2,213 for married taxpayers filing jointly. The second is the Public School Tax Credit, allowing taxpayers to directly support extracurricular activities at district and charter schools. For tax year 2018, this credit was $400 for married taxpayers filing jointly.

Funding for Individual Students

Empowerment Scholarship Accounts

The Empowerment Scholarship Account (ESA) program is administered by The Arizona Department of Education funded by state tax dollars to provide educational options for qualified Arizona students. By opting out of the public school system, parents can seek a range of alternative educational services such as private school or home-based education. The program was created in 2011 for special needs students but has expanded over the years. Funds can only be used for specific expenses and parents are required to submit quarterly expense reports with receipts. Base funding is 90% of the amount that is given to the district and is distributed through pre-paid debit cards. Average ESA funding is approximately $5,600 but students with special needs receive additional funding. Approximately 5,000 students participated in the ESA program in 2017-2018 school year. See Arizona statutes 15-2401 through 2404 for laws regarding ESA’s.

The ESA program was established with the passage of SB 1553. In 2017, two bills were proposed (SB 1431/HB 2394) that sought to expand eligibility to all district / charter school students by phasing in certain grades over a four-year period. SB 1431 was passed by the Senate and signed by Governor Ducey in April 2017, but that expansion is on hold pending the outcome of a veto referendum. In protest to the bill, Save Our Schools, a coalition of educators, collected enough signatures to bring the decision to enact SB1431 to voters in November 2018 as Proposition 305. The ESA program has also been challenged in court, citing that it favored private schools and religion. The Arizona Court of Appeals said it did not violate the state constitution because funding can be used for a variety of educational resources in addition to private school tuition. The Arizona Supreme Court upheld the decision by deciding not to hear the case.

ESA Eligibility for Preschool-12th Grade Students

- A child with a disability.

- A child attending a failing school or school district.

- An incoming Kindergartner who resides within the boundaries of a failing school or school district.

- A child with a military parent or guardian on active duty or who was killed in the line of duty.

- A child who is a ward of the juvenile court and is residing in prospective permanent placement foster care.

- A child who is a ward of the juvenile court and who achieved permanency through adoption.

- A child who is the sibling of a current or previous ESA recipient or of a student eligible for an ESA.

- A child who lives on an Indian reservation.

- A child of a parent who is legally blind, deaf, or hard of hearing.

The ESA participant also must meet at least one of a second set of conditions:

- A full-time Arizona public school student who attended at least the first 100 days of the prior year.

- A prior ESA participant.

- A student who received or was eligible to receive a displaced or disabled School Tuition Organization (STO) scholarship and previously attended public school full time.

- An incoming kindergartner.

- A child who currently is eligible to enroll in a public school program for preschool children with disabilities.

SB 1431 Proposed Expansion Eligibility

- 2017-2018, Kindergarten or grades 1, 6, and 9

- 2018-2019, Kindergarten or grades 1, 2, 6, 7, 9, and 10

- 2019-2020, Kindergarten or grades 1 through 3 and 6 through 11

- 2020-2021, All K-12 students

School Tuition Organization (STO) Scholarships

Certified School Tuition Organizations (STOs) are established to receive income tax credit contributions that fund scholarships for students to attend qualified private schools located in Arizona (A.R.S. Title 43, Chapters 15 and 16). A nonprofit organization in this state that is exempt or has applied for exemption from federal taxation under section 501(c)(3) may apply to the Arizona Department of Revenue for certification as an STO. Once certified, an STO may receive tax credit donations from individual and/or corporate taxpayers. A list of certified STOs may be found here.

The Internal Revenue Service has recently issued a proposed rule, which is currently undergoing public comment, that STO tax credit donations are not deductible on federal income taxes if the tax credit is claimed. The rule was issued on a Friday in August 2018, to take effect the following Monday.

School Finance 101

In this presentation, the Arizona Tax Research Association, a 75-year-old taxpayer watchdog group, provides a quick look at how Arizona public schools are funded. As we said above, it's complicated. For now we've given up summarizing the info here, but some of the numbers are eye-opening and do not match much of the public rhetoric. See our Financial Accountability page for an update on teacher pay.

School Finance 101 2018 (pdf)

Download